Thoughts on the collapse of Silicon Valley Bank

Recent fears of a new financial crisis in the US have been alleviated for now, though they reached their peak due to the supply chain crisis brought on by the pandemic, Russia’s invasion of Ukraine, and the rise in energy prices that pushed inflation rates to historic levels. To combat inflation, the US Federal Reserve has been aggressively increasing interest rates for the past year. While the Fed managed to reduce inflation from over 8% to 6%, it remains far from its target of 2%. However, despite interest rate hikes, the strong course of employment and the failure to slow down economic activity have raised questions about how long the Fed will continue to raise interest rates.

In the wake of the collapse of Silicon Valley Bank and Signature Bank last week, concerns were raised about the Fed freezing or minimizing rate hikes. But the acquisition of Credit Suisse, Switzerland’s second-largest bank, by its rival UBS has eased fears of a global banking crisis, at least for now. Additionally, the U.S., Canada, England, Japan, and European central banks are making swap agreements to increase dollar liquidity in markets and calm them down. If the thesis that the Fed’s high interest rate policy is effective in averting a banking crisis gains ground, the aggressive stance on interest rate hikes may soften.

The recent struggles of Silicon Valley Bank and Signature Bank have led to fears of a new financial crisis, and the Biden administration is taking action to prevent this from becoming a reality. The administration is also preparing for the possibility of a debt ceiling crisis in the coming months due to the Republican majority in the House of Representatives after the midterm elections. President Biden recently presented his budget proposal to Congress, but faces opposition from Republicans who want to use the debt ceiling as a bargaining chip in budget negotiations. Failure to raise the debt ceiling could result in the US being unable to pay its debts for the first time in history, leading to a global economic crisis.

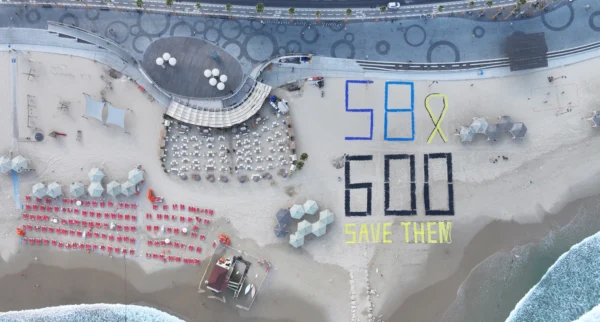

In the midst of this, fears of a “bank rush” have emerged, with concerns that other American banks and financial institutions may collapse. The Biden administration has intervened to prevent depositors from withdrawing their funds and causing a wider panic. While the Federal Deposit Insurance Corporation (FDIC) normally insures bank deposits up to $250,000, this amount is not sufficient for technology giants and other companies with large deposits. The tech entrepreneurship sector has appealed to the federal government to protect their deposits, and the government has taken steps to ensure their money is safe.When fears about the Silicon Valley Bank (SVB) failing began to spread, the technology sector launched an effective lobbying campaign to protect its assets. Despite there being no government guarantee for deposits over $250,000, companies that stood to lose substantial amounts of money due to the bank’s collapse took advantage of the fear that a wider banking industry collapse would occur. In the past, taxpayers have been unhappy about bailing out “irresponsible and greedy” banks during times of crisis. President Biden sought to assuage public concerns by announcing that taxes would not be used to rescue the SVB.

The technology entrepreneurship sector prides itself on taking high risks to promote technological advancement, and it has historically advocated for minimal state interference. SVB, the 16th largest bank with $210 billion in assets, facilitated the financing of technology start-ups and held deposits from entrepreneurial firms. Ironically, the sector, which opposes federal government interference, demanded deposit protection when the bank faced trouble.

Despite opposition to such interventions, it has become a trend for the federal government to intervene and play the role of savior during financial crises. In previous crises, governments have suspended the rules of the game, as seen in the 2007 financial crisis, the pandemic, and the recent SVB crisis. These interventions come at a high cost, including increasing debt, deepening income inequality, and creating discontent among the lower-middle class. The need for the government to play a role in financial crises highlights the problems with American liberal capitalism, which allows for the emergence of large and efficient companies that cannot be allowed to go bankrupt, creating a system that consistently protects “big money.”