The limits of US-China economic rivalry

The intense global economic rivalry between the US and China is leading to a fierce competition, particularly in the advanced technology sector. While Washington imposes measures to limit the export of high-tech products to China, Beijing is not sitting idle. A recent example is Intel, the giant US computer chip producer, retracting its decision to acquire Israel’s semiconductor chip manufacturer, Tower Semiconductor. Intel had initially planned to acquire Tower to remain competitive in chip manufacturing and had obtained approval from American authorities. However, after waiting for 18 months without approval from Chinese authorities, Intel was forced to announce the cancellation of the acquisition. Intel, which generates 27% of its global revenues from China, avoiding jeopardizing this relationship, demonstrates how complex the economic battle between the US and China has become.

MUTUAL DEPENDENCY

This incident, showcasing the ongoing intense competition between the US and China, also serves as a reminder of how interdependent their economies are. The contribution that fueled China’s rise was primarily the result of American companies recognizing the cheap manufacturing capacity in China. In the 1990s, aided by the internet revolution, the globalized world economy rapidly diminished the significance of distances, making it easier to transfer production to distant countries. American companies engaged in production in countries like China, Taiwan, and Korea while discovering these nations also offered significant markets.

In the past 20 years, American giants such as Apple, Starbucks, Nike, Boeing, Disney, GM, McDonald’s, and Walmart competed to increase their shares in the Chinese market. Initially, China functioned as the provider of cheap production for products consumed in America and Europe. However, China’s strengthening economy led these companies to magnify their direct investments in China. For instance, while Starbucks has around 16,000 locations in the US, it has reached 6,500 locations in China. Apple, heavily reliant on China’s supply chain for iPhone and iPad production through its agreement with Foxconn, has around 270 stores in the US compared to about 50 stores in China. These examples underscore the significant role the Chinese market plays in the balance sheets of American corporations.

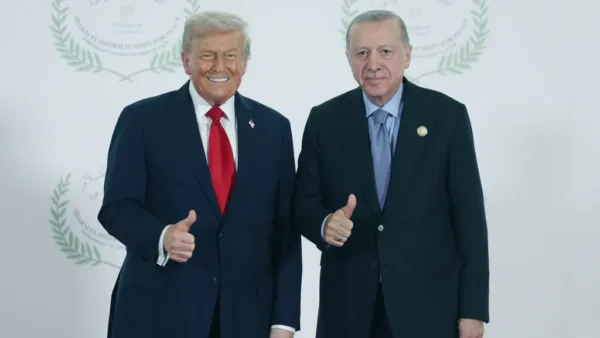

The Trump administration’s approach of openly and sternly conducting economic competition with China resulted in the implementation of additional tariffs and sanctions. Faced with the threat of losing leadership in 5G technology to China, Washington penalized Chinese firms like Huawei and attempted to dissuade European and other allies from engaging with Huawei. The Biden administration is also encouraging American companies to reconsider their relations with China by making their exports to China in critical technology sectors more challenging. Although many American firms that moved their production infrastructure to China are exploring alternative countries, the cost of exiting the Chinese market remains high, especially post-pandemic.THE COST OF EXITING THE CHINESE MARKET

We observe that the highly interdependent nature of the American economy with China forces the US to be cautious and selective in pressuring China. The efforts of the Biden administration to prevent the transfer of expertise in advanced technologies such as artificial intelligence and semiconductor chip production to China can be seen as aimed at this goal. While Washington battles China on technological espionage, it also strives to maintain American leadership in areas like space and artificial intelligence. However, it must avoid taking steps that would harm American companies’ balance sheets.

In the economic competition with China, the US holds numerous advantages, such as in R&D, creativity, entrepreneurship, and its critical role in Western markets. On the other hand, American companies’ dependence on China’s supply chain and the significance of the Chinese market in their balance sheets highlight factors preventing Washington from implementing more stringent measures. Even a symbolically significant company like Disney venturing into productions for the Chinese market (e.g., Mulan) and firms like Google accepting censorship and restrictions in China exemplify how indispensable this market is.

However, it’s important not to interpret these dynamics as exclusively favoring China. Companies remaining caught between Washington and Beijing will also incur significant costs for the Chinese economy. While Intel’s failure to obtain approval from Chinese authorities may not lead the company to exit the Chinese market immediately, it could prompt them to seek alternatives for similar scenarios in the future. Some American firms entering production agreements in countries like India, Vietnam, Taiwan, and Korea could be viewed as efforts to reduce dependence on China. The depth and complexity of mutual dependence between the US and China define the boundaries of the global economic competition between the two countries.